Limited Fsa Eligible Expenses 2024

Limited Fsa Eligible Expenses 2024 – A Limited Purpose Flexible Spending Account (LPFSA) is an employer-owned and funded account to which an employee may contribute pre-tax funds that may be used tax-free for eligible expenses incurred . FSA accounts have use-it-or-lose-it provisions that require enrollees to spend the funds on qualified expenses before the end of the calendar year the contribution was made. Plan sponsors can .

Limited Fsa Eligible Expenses 2024

Source : mymidamerica.comFlexible Spending Account contribution limits to increase in 2024

Source : www.govexec.com24 Coolest Wellness & Gadget FSA Finds / HSA Items in 2024; From a

Source : www.thebossysauce.comHow to Use a Limited Purpose FSA (LPFSA)

Source : www.investopedia.com2024 FSA Eligible Items & Where To Buy | MetLife

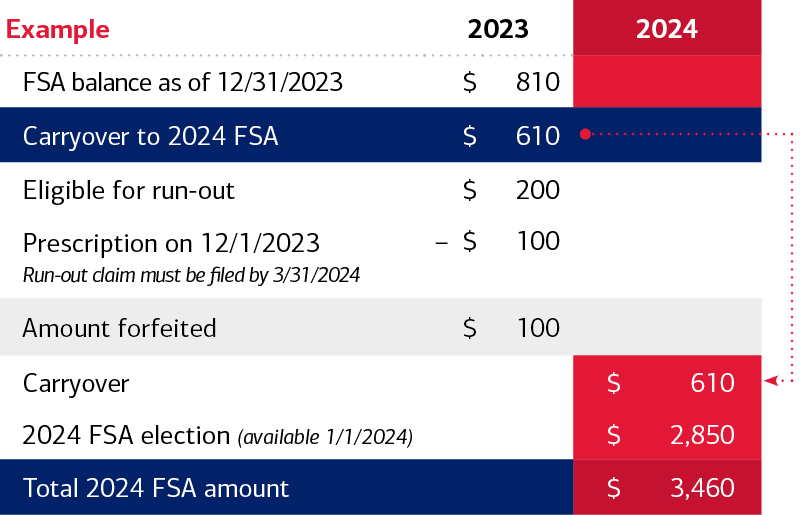

Source : www.metlife.comUnderstanding the year end spending rules for your health account

Source : healthaccounts.bankofamerica.comIRS Announces 2024 Increases to FSA Contribution Limits | SEHP

Source : sehp.healthbenefitsprogram.ks.gov2024 flexible spending account maximums have increased

Source : www.k-state.eduEmployee FAQ:

Source : amben.comFSA Contribution Limits | Lively

Source : livelyme.comLimited Fsa Eligible Expenses 2024 FSA Eligible_Limited Purpose List ‹ MidAmerica: Other Specialized FSAs: Some employers may offer specialized FSAs, such as a Limited Purpose FSA (LP-FSA) or Qualified Transportation Fringe Benefits FSA (Commuter Benefit). These cater to specific . What is an eligible FSA expense? FSA eligibility rules are determined by the Internal Revenue Service (IRS) and Internal Revenue Code section 213(d). FSAs can be used for a wide variety of clinical .

]]>

:max_bytes(150000):strip_icc()/Section-125-plan-cafeteria-plan-how-does-it-work_final-8bbf928cabad4e718ccb6d6e4be086d8.png)